If you’ve been an avid reader of ‘rate update‘ then you know that I often refer to ‘technical trading patterns’ (TTPs) as a factor that can have a major influence mortgage rates. Typically TTPs have the most impact when the markets lack new economic data and/ or significant stock market momentum.

However, very few people are familiar with the concept of TTPs and how they impact mortgage rates. In this post I will attempt to explain what TTPs are and how they impact our advice to “lock” or “float” interest rates.

To preface this explanation it’s first critical that you know that mortgage rates are 100% determined by the price of mortgage-backed bonds (MBS’s). When the price of MBS’s increase, mortgage rates decline. When the price of MBS’s decrease, mortgage rates increase.

TTPs are essentially derived from the discipline of technical analysis. Believers in technical analysis claim that previous price data for a specific financial security can be used to predict the future movements of that price.

In this case, TTPs offer a way for us to assess patterns in the price history of MBS’s and determine how future prices will react.

Specifically, in evaluating TTPs we look for where the current price level for MBS’s are relative to the average price levels over a 10, 25, 40, 50, 100, and 200 day time frame. These averages are called “moving averages” and are calculated by averaging the price level of MBS’s over a specified time frame.

For example, the “10-day moving average” is calculated simply by averaging the price of MBS’s over the previous 10 days. Likewise, the “200-day moving average” is calculated by averaging the price level of the previous 200 days.

What makes identifying TTPs possible is that MBS prices often react in a consistent manner when they approach these “moving averages”. Therefore, we often see very predictable patterns of price changes when MBS’s approach these levels. Because mortgage rates react inversely to the price of movements of MBS’s once we can accurately predict price movements we can also predict mortgage rate movements.

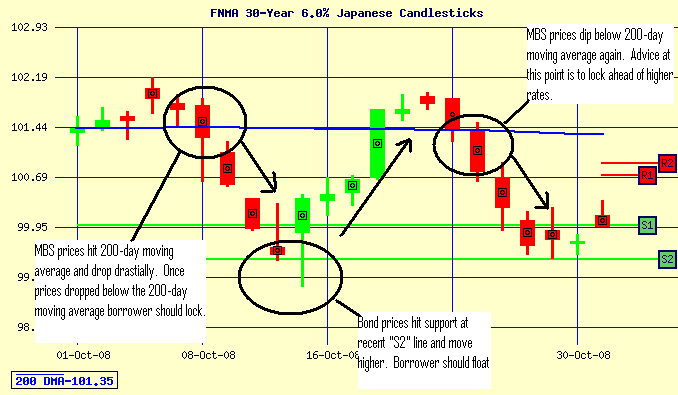

For example, in the chart below look at the first circle near the top left hand corner. At this point MBS prices are falling and approaching the 200-day moving average (blue line). We know that when MBS prices approach this level they tend to react in one of two ways.

One reaction is for them to “bounce” higher off the 200-day moving average which causes MBS prices to rise and rates to drop. However, in this instance MBS prices reacted in the opposite manner. They dip below the 200-day moving average and rates rise as a result.

At times like this we would advise or clients to float as long as MBS prices remain at or above the 200-day moving average. As soon as they close below the 200-day moving average we know rates will get worse before they get better. Therefore, we advise a “locking” position as soon as MBS prices dip below the 200-day moving average.

The second circle near the bottom of the chart shows MBS prices getting support at the “S2 line” (green line) which is not a moving average but likely a low-point in recent trading history. At this level MBS prices are able to find a bottom and begin rallying. At this time mortgage rates are likely .25%-.375% higher compared to only a few days earlier (when MBS prices were up near the 200-day moving average). Because MBS prices appear to have bottomed we would recommend a “floating” position at this point as mortgage rates show signs of improvement.

Indeed, off this floor MBS prices rally for 5 days and rates drop back down by .25%-.375%. Once they approach the 200-day moving average the rally loses steam and in the third circle show signs of weakness.

Much like our approach at the first circle we would recommend a “floating” position so long as MBS prices remain at or above the 200-day moving average. As soon as prices dip below this level we know that prices are likely to decline pushing rates higher by .25%-.375% once again.

This is just one example of how we would use technical analysis to identify TTPs that will impact mortgage rates. This concept is somewhat complicated and takes time to learn. If you have questions about TTPs or would like to make a comment please do so below.