Mortgage rates are moderately improved from Thursday.

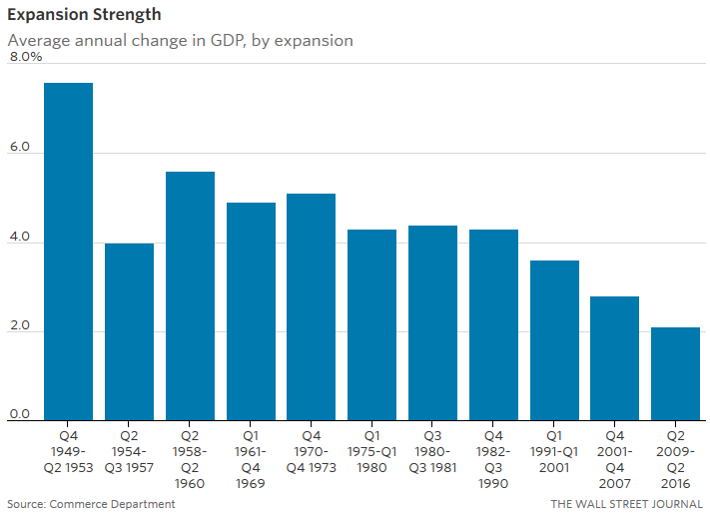

On Friday the Commerce Department released Gross Domestic Product figures for the final quarter of 2016. It showed that the economy expanded by a 1.9% annual pace for the final three months of the year which is lower than the markets were hoping for.

The current cycle of economic expansion began back in 2009 making it one of the longest on record. However, since then the overall economy has only grown by 15.5% making it one of the shallowest as well.

This week’s economic calendar is a busy one. Earlier today we got the latest reading on the Personal Consumption Expenditure Price Index which is the Fed’s favorite gauge of inflation. Excluding volatile food and energy prices the index rose by 1.7% from last year which is still below the Fed’s target of 2% but trending higher. Inflation is the primary driver of long-term interest rates.

On Wednesday the Fed will release its latest monetary policy decision. It is widely expected that the Fed will leave short-term interest rates unchanged after hiking in December. However, as we know their comments can also impact the financial markets.

Lastly, on Friday we’ll get the latest all-important jobs report. I will focus on that in my Thursday ‘rate update’.

Mortgage rates are attempting to improve but face strong technical resistance. I recommend a locking bias.

Current Outlook: locking