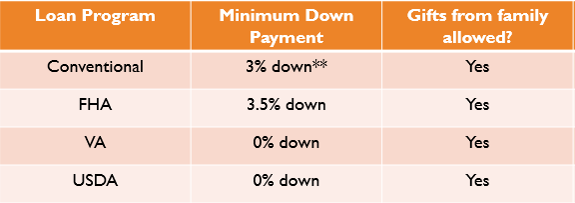

I came across an article over the weekend which stated that roughly 40% of US citizens between the ages of 25-34 believe that lenders require at least 15% down payment in order to purchase a home. This may be one reason why those in the “millennial” generation have lagged their predecessors in home-ownership rates (there are certainly other factors). The truth is that there are many programs which allow for less than 5% down and all of them allow the down payment to be 100% gifted by a family member.

Of course all these programs are subject to qualifying and there are some caveats. But, if you or someone you know has been putting off buying a home because they thought they needed to save more money its probably worth exploring options now given that interest rates are very attractive and most analysts believe home prices will continue to rise. I’d love to be a resource for you so don’t hesitate to let me know if you’d like to engage in a conversation about your circumstances.