Fed flattens yield curve

On this day in 2006 the Oregon State Beavers baseball team lost its opening game in the College World Series. They would come back to win five of its next six games to claim the national championship. We’ll see if the 2018 team can follow the same pattern!

Mortgage rates improved modestly last week.

The Fed

As expected the Fed did hike short-term interest rates on Wednesday of last week. As a reminder the Fed does not directly set mortgage rates. They also set the expectation that they would hike two more times in 2018 and two to three more times in 2019.

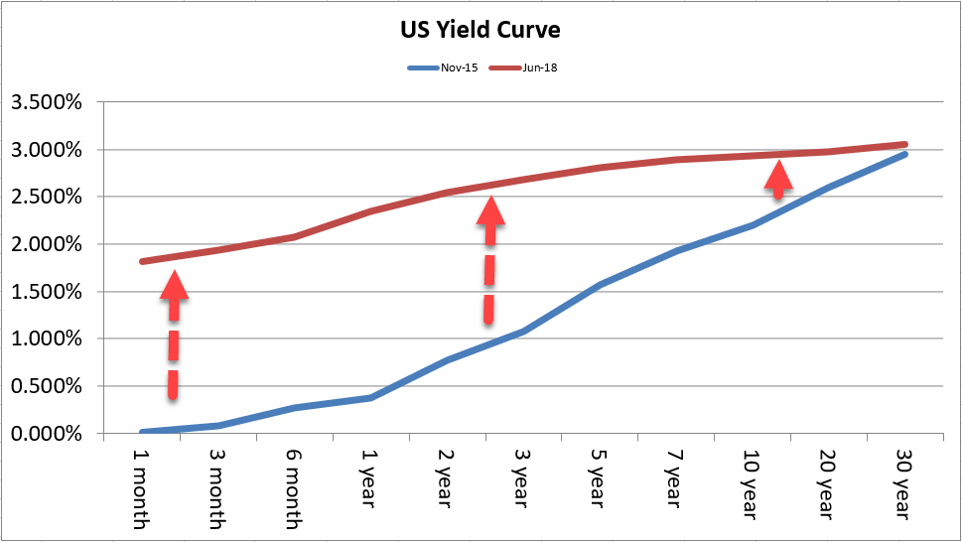

Yield Curve

The yield curve has flattened over the past three years with rates at the short-end of the curve increasing by ~1.5% while rates at the long-end have increased less.

Some economists believe that a flat yield curve is an indicator for a recession. This coupled with low unemployment (see HERE) have me feeling more and more like we will see an economic slowdown in the next 12-24 months.

US Stocks

The US stock market was trading lower on Monday in response to tariff threats between the US and China. Late last week President Trump approved 25% tariffs on approximately $50 billion of Chinese exports. China countered over the weekend with penalties on US products sold in China. Although tariffs will help some industries most economists agree it will not be favorable for the economy as a whole.

Bad news for the economy tends to be good news for home loan rates.

The Week Ahead

This week’s economic calendar is relatively light. There are significant housing related reports such as housing starts & building permits (Tuesday), existing home sales (Wednesday), and leading economic indicators (Thursday).

Current Outlook: cautiously floating