Rent vs. Buy break-even

During my initial call with a new customer who is interested in purchasing their first home I like to ask what their motivation is for buying. Their answers can provide valuable insights in understanding what is ultimately important about their decision making process. As you might imagine, most of the customers I have spoken with over the past year have indicated that they are tired of paying ever higher rents to their landlord.

With rents increasing so significantly in our marketplace the monthly payments associated with owning a home look ever more attractive. But for some the nature of their employment or other factors may not keep them in a home long-term. Inevitably the decision to purchase or rent is looked at through a financial lens. Does it make sense to buy or continue to rent?

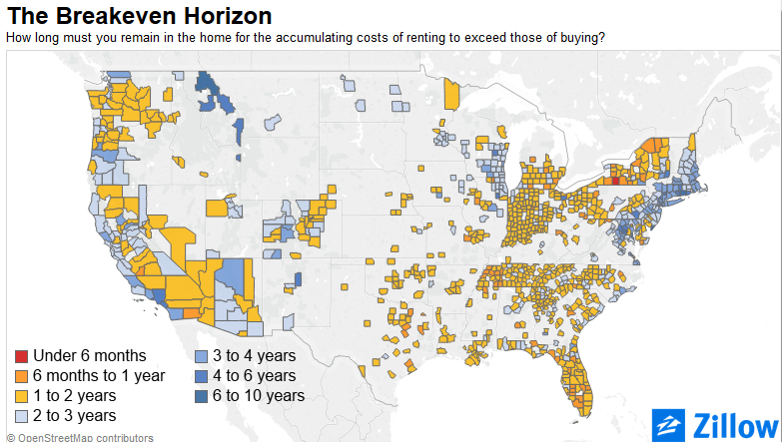

Zillow maintains an ongoing “break-even horizon” for housing markets across the country which measures the financial break-even between owning and renting. The analysis takes into account inflation, property taxes, tax benefits, home appreciation, rental appreciation, and opportunity costs. You can read the complete methodology HERE.

According to this analysis Zillow estimates the current “break-even” at 2.1 years for the Portland market. In other words, a home buyer would need to keep the home for at least 2 years and 2 months in order break-even financially as compared to renting. Beyond that they should come out ahead assuming Zillow’s assumptions prove accurate which is never a guarantee.