If there is one thing I’ve learned over the years with regard to personal financial planning it’s that reviewing tax changes EARLY in the new year is important. By the time December rolls around it is typically too late to make any meaningful changes to your tax bill for that year. This will be especially applicable in 2012 & 2013 when many tax cuts are currently set to expire. I am in the process of updating my tax summary sheet that focuses on personal & real estate related tax provisions. I will upload it to this blog once complete. In the meantime, HERE IS A LINK to a 4-minute summary of what you should know. Please remember that it’s an election year and many in Washington DC may be extending some of these provisions to help their reelection chances. In general, tax laws can change during the year and even retroactively so it’s best to talk with a competent tax professional about your individual situation.

Category: Personal Finance

Real Property Tax Explanation for Oregon

The Oregonian’s Brent Hunsberger wrote a good article over the weekend outlining Oregon’s confusing property tax rules. What makes things difficult for homeowners to understand is why their property taxes rise even when their home value declines. Brent does a good job of explaining:

“…tax bills will go up even though real market values declined again as of January 2011, the date of record for valuations, and were down at least 20 percent from their peak in 2008.

You can thank Oregon’s tax system for that.

In the ’90s, Oregon voters passed two constitutional amendments limiting growth in property taxes. One essentially divorced real market values from so-called assessed values. The lower value is used to calculate the taxes you owe.

The second amendment in 1997 capped property tax increases to 3 percent a year, though it exempted remodeling, new additions and new voter-approved levies from that cap. That measure also cut tax bills overall.

Market values skyrocketed after that while assessed values bumped up at a more modest rate. By 2008, real market values across the state were 86 percent higher than assessed values, according to the Oregon Department of Revenue. And though market values have declined since then, they still remain about one-third higher than assessed values in Portland’s urban counties. “

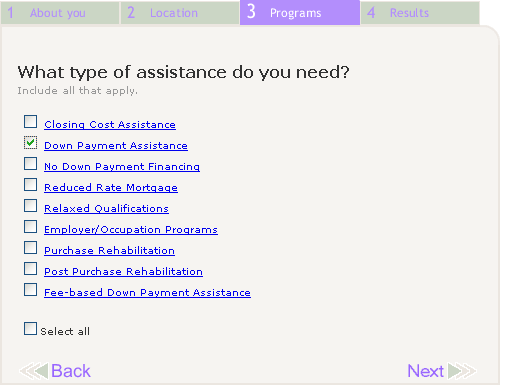

Are you looking for homebuyer assistance in PDX-Metro area?

In my interactions with first-time homebuyers I am often asked about special assistance programs that may be available for them. I recently came across the HOMEOWNERSHIP OPPORTUNITIES WEBSITE NORTHWEST which provides a search tool where you can plug in information about yourself and see what programs might be available to you. It’s an easy way to do research on the various types of programs that are available.

Is hourly-based financial planning right for you?

If you’ve been following this blog for sometime then you may know that I earned my CFP® designation in 2010 and have begun working on a limited basis with clients providing financial planning services. At this point I do not offer any financial products or services aside from my mortgage practice and am charging for my time. This planning model is not very common so I am often asked how it works. Allan Roth wrote THIS PIECE for moneywatch.com in which he lays out the pro’s & con’s of hourly-based planning nicely. Here are some excerpts:

Pro’s:

- “Fewer conflicts – Sheryl noted that the hourly model had less incentive to give a recommendation to benefit the advisor. For example, paying off a mortgage would mean less revenue for other fee models. Converting a 401K to an IRA also has more conflicts in the other models since more assets equals more fees or commissions.”

- “More flexibility – Sheryl stated hourly advisors can recommend any product, as opposed to other fee models that are limited to being within a certain platform. For example, why would a fiduciary have their client in a money market earning 0.05 percent when there are safe places to stash your cash earning 20 times the amount? Also, certain CDs like Ally Bank and Security Service have great rates that also protect against the bond bubble. The hourly model doesn’t have the incentive to capture assets.”

- “Works for the little guy – Sheryl says the client doesn’t have to have much money for the planner to be cost effective. The client may just need a couple of hours of advice and can be on their way, much in the same way they may need an attorney for one particular issue.”

Con’s:

- “Client won’t seek advice – An argument for the percentage of assets model is that the client can call at any time without the clock running. They are not as likely to seek advice they may need if they are going to receive a bill for that call. I’ve also heard the criticism that hourly planners can over-bill their hours, though any fee model is vulnerable to fraud.”

- “Client won’t implement – The argument here is that the other fee models give the advice and implement it. Hourly planners, including myself, give a written plan, discuss it with the client, but don’t always get involved in the implementation.”

- “Not conducive to an ongoing relationship – People need ongoing advice from a long-term trusted advisor, rather than a one-time engagement.”

And my favorite quote of the article:

“A rule of thumb for all consumers to follow is that if you can’t explain your investments simply, you don’t understand them. And if you don’t understand them then you are probably transferring your wealth to your advisor.”

Anchor and Adjustment

I am slowly making my way through Jason Zweig’s book Your Money & Your Brain which is credited as being one of the books that brought the topic of neuroeconomics into the mainstream. I have been fascinated with some of the concepts and experiments that Zweig outlines in this book. One of these concepts he calls ‘anchor & adjustment’ and is used to describe the process by which our brains operate in terms of coming up with estimates for answers we may not be certain about.

He gives the example of asking how old John F. Kennedy would be today if he were alive. Go ahead and ask yourself that question.

If you’re like most people you might think 75-80 at first and then after taking longer to ponder the question adjust your answer higher to 85-90. The truth is that JFK was born 05/29/1917.

When our brains are posed with a question and we are not certain about then our intuition “anchors” our initial guess. This emotional response will typically be influenced by our previous experiences and memories (think of JFK’s youthful face). However, with time, the rational part of our brain enters the estimation process and begins to use reason in determining our final guess. Zweig calls this process the “adjustment” phase. This is when most people begin to increase their guess of JFK’s age today. However, because our initial guess was “anchored” in our emotional response by the time our rational brain takes over it is difficult to “adjust” our answer high enough to compensate for the initial anchor. As a result, our final estimate is somewhere between the correct answer and our “anchor”.

For trivial matters like the aforementioned JFK question it may not make much of a difference. However, in the financial planning process this is important to understand. For example, if a household is estimating the return on their investment savings/ inflation and their assumptions are influenced by this process then the initial estimates could be far from reality causing them to under-save or over-save during their lifetime.

This process is biological in nature and impossible to reverse (without millions of more years of evolution). Having said that, if we are aware of this process we can consider the impact that our emotions have on our ability to estimate things in our lives (including financial figures).

How to apply asset allocation to multiple investment accounts

Mike over @ the Oblivious Investor blog sent out this post this morning regarding the application of asset allocation targets to multiple investment accounts. It addresses the question of whether or not an investor needs to apply an asset allocation target to each and every investment account they own (i.e. IRA, 401K, and brokerage account) or if they can view all the accounts holistically and apply the target to all of them as if it was one big portfolio.

In Mike’s opinion the latter is preferable because it allows the investor to shelter the gains in a tax-free account (i.e. IRA or 401K) and hold cash and fixed income investments in taxable accounts. Furthermore, he points out that it’s worth evaluating the expense ratios of various funds of the same asset class to see where the investor can reduce investment expenses.

To demonstrate he provides this example:

How about an Example?

Sarah has decided that she wants the following asset allocation:

- 40% U.S. stocks

- 30% International stocks

- 30% Bonds

She has $50,000 in a taxable account at Vanguard, $150,000 in a traditional IRA also at Vanguard, and $100,000 in her 401(k) run by Fidelity. (So her total portfolio is $300,000, and she wants $120,000 in U.S. stocks, $90,000 in bonds, and $90,000 in international stocks.)

Sarah has the following investment choices in her 401(k):

- Fidelity Capital & Income Fund (expense ratio 0.76%)

- Fidelity Small Cap Stock Fund (expense ratio 1.25%)

- Fidelity Select Health Care Portfolio (expense ratio 0.88%)

- Spartan Total Market Index Fund (expense ratio 0.10%)

- Fidelity Strategic Income Fund (expense ratio 0.71%)

- Fidelity Blue Chip Growth Fund (expense ratio 0.94%)

- Fidelity International Growth Fund (expense ratio 1.90%)

- Fidelity Total International Equity Fund (expense ratio 1.79%)

Sarah could implement her desired 40/30/30 allocation in each of her accounts, or she could implement that allocation for the portfolio as a whole.

The “Multiple Portfolios” Approach

If Sarah views each account as a separate portfolio and uses her 40/30/30 allocation in each one, her holdings might look something like this:

Taxable account:

$20,000 Vanguard Total Stock Market Index Fund

$15,000 Vanguard Total International Stock Index Fund

$15,000 Vanguard Total Bond Market Index FundTraditional IRA:

$60,000 Vanguard Total Stock Market Index Fund

$45,000 Vanguard Total International Stock Index Fund

$45,000 Vanguard Total Bond Market Index Fund401(k):

$40,000 Spartan Total Market Index Fund

$30,000 Fidelity Total International Equity Fund

$30,000 Fidelity Strategic Income FundThe “Single Portfolio” Approach

In contrast, if she looks at everything as a single portfolio, she could do something more like this:

Taxable account:

$50,000 Vanguard Total International Stock Index FundTraditional IRA:

$40,000 Vanguard Total International Stock Index Fund

$20,000 Vanguard Total Stock Market Index Fund

$90,000 Vanguard Total Bond Market Index Fund401(k):

$100,000 Spartan Total Market Index FundWhy is the Second Portfolio Better?

The second portfolio is an improvement over the first for at least a few reasons:

- It uses only low-cost funds, whereas the first portfolio has 60% of Sarah’s 401(k) invested in high-cost funds just to meet the 40/30/30 allocation in that account,

- It’s more tax-efficient because it places all of her least tax-efficient holdings (the bonds) in a tax-sheltered account, and

- It has only five moving parts to monitor rather than nine.

And Sarah’s situation is relatively simple. For investors with more accounts (especially married couples) or more complex asset allocations (i.e., more than 3 distinct asset classes), the complexity resulting from using the target allocation in each account can be significantly worse.

Looking for ideas on how to track spending/ build a budget?

Matt Jabbs wrote THIS PIECE on the Debt Free Adventure website in which he makes a couple suggestions for how to track your spending. I’ve blogged many times about how getting control of your cash-flow is the primary driver of building wealth yet also the most elusive for so many households. If you spend as much as you bring in or more (meaning you’re building debt) then it is impossible to put money away into savings & investments. If you can live below your means then you begin to build savings which can be used to invest and grow. Make it your summer resolution to take care of this and contact me if you need an accountability partner.

Matt Jabbs wrote THIS PIECE on the Debt Free Adventure website in which he makes a couple suggestions for how to track your spending. I’ve blogged many times about how getting control of your cash-flow is the primary driver of building wealth yet also the most elusive for so many households. If you spend as much as you bring in or more (meaning you’re building debt) then it is impossible to put money away into savings & investments. If you can live below your means then you begin to build savings which can be used to invest and grow. Make it your summer resolution to take care of this and contact me if you need an accountability partner.

Tax provisions regarding debt foregiveness on a short sale or foreclosure

I was recently asked by a real estate professional if I knew the tax implication of a homeowner having mortgage debt forgiven via a short sale or foreclosure. At the time I did not but have since researched the issue and thought I would blog about it. Keep in mind that I AM NOT a tax professional and if the topic in this post pertains to you then I recommend you seek individual help from a qualified tax professional.

In general, this topic is covered in section 108 of the Internal Revenue Tax Code. Mortgage debt forgiven via a short sale or foreclosure can be excluded from taxable income so long as it meets a set of rules. CLICK HERE to read a print off directly from the 2011 CCH US Master Tax Guide about these rules. The mortgage debt must have been qualifying acquisition indebtedness (any “cash-out” will be included in taxable income) and it must have been secured against the tax filers primary residence. This provision is set to expire in 2012.

In general, this topic is covered in section 108 of the Internal Revenue Tax Code. Mortgage debt forgiven via a short sale or foreclosure can be excluded from taxable income so long as it meets a set of rules. CLICK HERE to read a print off directly from the 2011 CCH US Master Tax Guide about these rules. The mortgage debt must have been qualifying acquisition indebtedness (any “cash-out” will be included in taxable income) and it must have been secured against the tax filers primary residence. This provision is set to expire in 2012.

Also, in section 108 of the IRC it states that debt discharged as a part of a court approved Chapter 11 bankruptcy and/ or debt discharged when the taxpayer is insolvent outside of bankruptcy is also excluded from taxable income. I’m sure I am missing a lot of details so feel free to comment below if there are any important provisions I neglected to mention.

From this we can deduct that if a mortgage was used to acquire rental property or was used to pay-off consumer debt then any discharge of this debt will be included in a taxpayers gross income for tax filing purposes unless they are insolvent.

Has the housing market hit bottom?

Has the housing market hit bottom yet? In this week’s edition of The Economist magazine THIS ARTICLE was was published which points to a lot of encouraging evidence that would suggest we may be at bottom. Here are some excerpts:

*”House-ownership is beginning to look more affordable by many measures. Adjusted for inflation, prices are close to their long-term trend after the bubble years of the 1990s and the first years of the 2000s. And the ratio of house prices to rents has returned to its pre-bubble level (see chart).”

*”Vacancies for apartments tumbled in the first quarter of the year and are now at a three-year low. Rents have been rising, and analysts expect them to increase by over 4% this year and next. Rent rises typically support house prices by making home-ownership more attractive.”

*”The credit markets are healing. Mortgage borrowing actually rose in the first quarter, according to the Federal Reserve Bank of New York. New foreclosures were 17.7% lower in the first quarter than they had been at the end of 2010, and household delinquency improved for a fifth consecutive quarter. Mortgage rates have fallen back to historic lows, tracking declines in yields on American government bonds.”

*”Perhaps the best news for housing has come from the labour market. The economy added over 200,000 jobs in each of the past three months and over 1.3m jobs in the past year. A better job market enables struggling households to make mortgage payments, reducing foreclosures. For most of the bust, borrowers that fell behind on their loans were likely to end up in serious difficulties. In the first quarter of this year, for the first time since 2007, more mortgage borrowers caught up with their payments than fell further behind.”

Am I on track?

Since earning my CERTIFIED FINANCIAL PLANNER™ designation last year I have been asked numerous times by younger folks (I characterize “younger” in this instance to be < 40 years old) for help in determining if they are doing a good job with their finances. Since these people typically haven’t been exposed to much long-term financial planning they often don’t have specific goals in mind other than they want to know “how they’re doing”. As a planer “how I’m doing” is a relative measurement that is tough to evaluate.

I ran across an article in the “Ask the Expert” section of the June 2011 issue of Money Magazine win which a 31-year old asks the exact same thing. I like the simplicity of the answer which followed:

*To quit working at 65 with a decent shot at replacing 80% of your pre-retirement earnings, you’ll need savings equal to roughly 12 times you income (that assumes you’ll collect Social Security but no pension).

*By 35 you should have 1.4 times your pay tucked away. That ratio is 3.7 at 45, and 7.1 at 5….(the) math assumes you save 12% to 15% of your salary a year, including matches, and your investments beat inflation by 4.5% points a year.

*(If you’re not on track) you needn’t despair. There isn’t a single path to pone retirement destination. By living on 70% of your salary or working a few more years, you can cut the savings levels you must reach by 10% to 25%.

Keep in mind everyone’s situation is different and anytime you are investing there is risk and therefore no guarantee that everything will work out in the end. If you’d like some more personal attention feel free to contact me.