What do you call a cow with a twitch?….beef jerky……Happy National Craft Beef Jerky Day!

US Stocks & Interest Rates

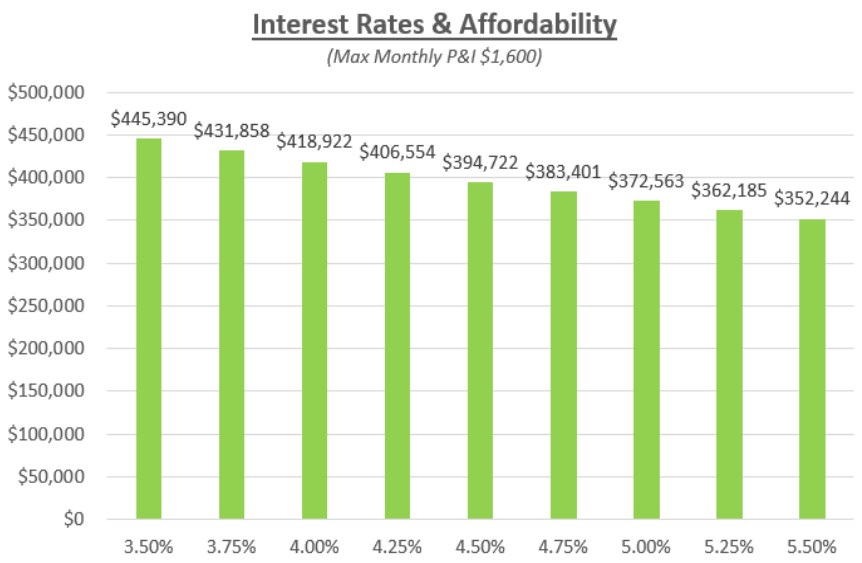

Economic uncertainty is taking a toll on the stock market and helping mortgage rates improve.

In an interview with the Wall Street Journal President Trump said it was “highly unlikely” that the US would accept a request from China to hold off on additional trade tariffs as the two countries head into a trade summit.

Furthermore, investors are less certain about the Fed’s future monetary policy as US interest rates head closer to a “neutral” level.

Economic uncertainty tends to discourage investment in the stock market and encourage capital to flow into safe-havens which helps US mortgage rates.

US interest rates are currently at two-month lows.

Housing Prices

As interest rates decline so do appreciation rates for homes. Home prices are still increasing year-over-year but not as rapidly as they have over the past few years.

The Case-Shiller Home Price index for Portland released earlier today shows that homes are 5.1% more expensive than they were 12 months ago. For a homebuyer who puts 10% down that is still a great cash-on-cash return.

Josh Lehner of the Oregon Bureau of Economic Analysis recently wrote THIS PIECE which explains how the housing market is re-balancing after years of under supply and strong demand.

The Week Ahead

This week’s economic calendar is busy. On Wednesday we’ll see new home sales and Fed Chairman Jerome Powell is scheduled to speak. On Thursday we’ll get minutes from the last Fed meeting and their favorite gauge of inflation (PCE price index).

Given that mortgage rates are at recent lows I recommend locking in.

Current Outlook: locking