As many prospective homebuyers are painfully aware mortgage rates have taken an acute shift higher since the election back in November. Mortgage rates have increased by .50%-1.00% depending the loan program and down payment. Depending on a prospective homebuyers approach this will impact people in different ways.

Lets look at an example of a homebuyer who is committed to a specific monthly payment of $1,600 per month for principal & interest or approximately $2,000 including property taxes and homeowner’s insurance (not an uncommon budget for the Portland-metro area).

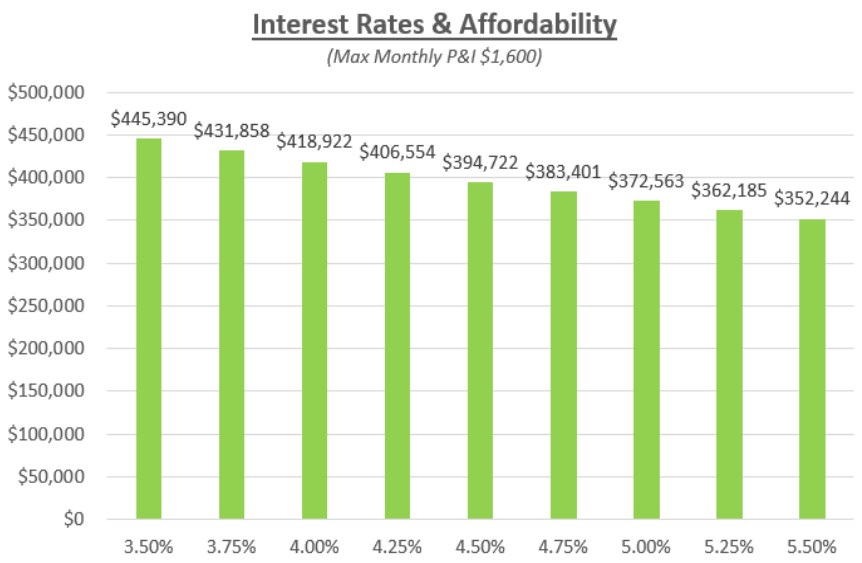

The chart below shows the maximum purchase price that buyer would need to look within assuming a 20% down payment.

As you can see throughout the summer of 2016, when mortgage rates were in the 3.50% range, a homebuyer with this budget could look for a home in the ~$445,390 price range and maintain payments within their target budget.

However, as mortgage rates have increased closer to 4.50% today their maximum purchase price has declined by ~$50,000 to ~$394,722. Effectively, a 1% increase in interest rates for a 30-year fixed rate mortgage reduces a homebuyers purchasing power by ~11%.

We do not know what the future holds for mortgage rates. As I have written repeatedly as of late in my ‘rate update‘ category I happen to believe interest rates have overreacted to the results of the election. If I am right then rates will reverse modestly lower and purchasing power will increase.

However, if I am wrong rates may continue to trend higher and homebuyers will need to either be willing to spend more per month or settle for less house.

Are you a prospective homebuyer? If so, I would love to be a resource for you. Please contact me for an initial phone conversation.