The Fed does not set mortgage rates

Later today the Federal Reserve Bank Open Market Committee (FOMC) is widely expected to hike short-term interest rates. Contrary to popular belief a Fed rate hike could actually help mortgage rates improve.

To understand why one must consider the reason why the Fed is hiking rates in the first place.

The Fed has a dual mandate which is to maintain:

- maximum employment

- stable prices and moderate long-term interest rates

Interest rate hikes are a tool the FOMC uses to help stabilize prices (AKA curb inflationary pressure). Inflation is the primary enemy of mortgage rates because it erodes the purchasing power of the money used to repay the loan.

Consider if you were planning on lending someone money today and deciding on what rate of interest to charge. If you were informed that the value of the money repaid to you in the future would have less purchasing power due to inflation you would be prudent to add that additional cost into the interest rate.

As the Fed hikes short-term interest rates it should theoretically prevent future inflationary pressure which is good for home loan rates.

The FOMC does not directly set mortgage rates. The rate they control is called the Federal Funds Rate and practically speaking has a very obscure function (it is the interest rate charged between banks to lend reserve balances for overnight depository requirements).

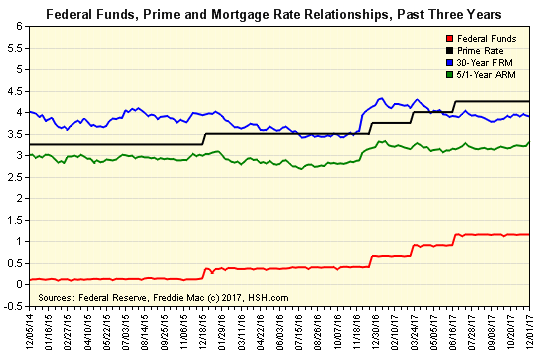

As the chart below shows there is no direct correlation between the Federal Funds Rate and mortgage rates.

As you can see from December of 2014 to December 2017 the Federal funds Rate increased from ~.25% to ~1.25% as a result of four separate rate hikes. At the start of that time period conventional 30-year fixed rate mortgage rates were averaging 4.00% and now? Still ~4.00%.

It’s important to note that the FOMC’s comments and actions can send ripple waves through the financial markets and can influence the direction of mortgage rates, for better or worse, but the Fed does not directly control the rates provided on home loans.