Mortgage Rate Update March 27, 2014

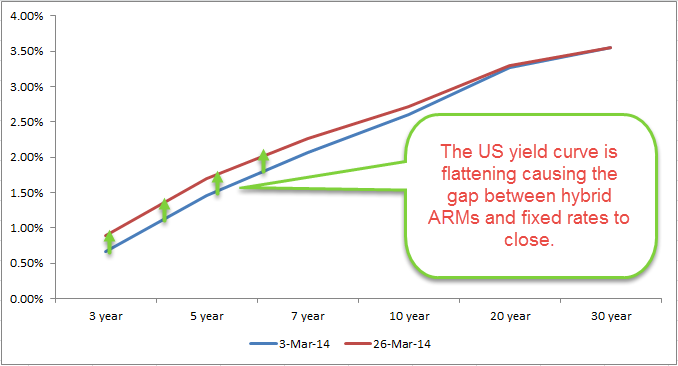

Fixed mortgage rates are priced slightly better today compared to earlier in the week but shorter-term hybrid ARM’s (i.e. 5/1 ARM) are the same or worse. Why are these moving in conflict with each other? If the Fed does move to raise short-term interest rates sooner than previously thought then the yield curve will flatten (the gap between short term rates and long-term rates will close).

In housing news, the National Association of Realtors reported that pending home sales fell by more than expected in February. However, the national figures were dragged down by declines in the Northeast and South where winter weather certainly played a role. In the West pending home sales grew by 2.3%. On the positive front, initial jobless were reported at the lowest level seen in 2014. Speaking of jobs, Oregon’s currently adding jobs at a faster rate than the national economy. New jobs=New Home Formations so this news is good news for housing.

Later today the US Treasury will auction $29 billion in 7-year notes. Yesterday’s 5-year note auction was met with very strong demand.

From a technical perspective it looks like rates may be at their best levels for the immediate term. Next week is jobs week and given that the last jobs report was the strongest we’ve seen this year I will recommend a locking bias.

Current Outlook: locking